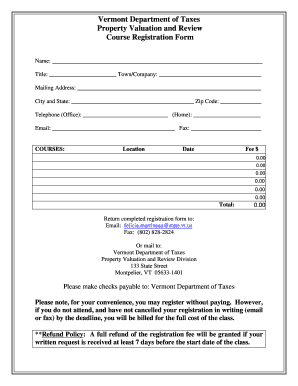

vermont department of taxes property valuation and review

Farnham Director Property Valuation and Review Division Vermont Department of Taxes Date. Chapter 154 on a current-year basis.

Audit Finds Few Problems With Barre Tif Vermont Business Magazine

Appeals to the Director of Property Valuation and Review.

. If PVR has authority to determine a propertys tax-exempt status that authority must come from somewhere. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. District Advisors Listers and Assessors Municipal Officials.

Honorable Mitzi Johnson Speaker of the House Honorable Tim Ashe Senate President Pro Tem From. PVR supports computer software programs used locally for grand list valuation and property tax. RP-1309 January 2022 2021 UTILITY AND HIGH VALUE COMMERCIAL PROPERTY.

This document fulfills the requirements of 32 VSA. Honorable Jill Krowinski Speaker of the House Honorable Becca Balint Senate President Pro Tem From. Annual Report of Property Valuation and Review Division I am pleased to present Property Valuation and Reviews 2015 Annual Report of the 2014 Grand List year.

Grants are available for municipal officials who must commute 50 miles or more one way and applications must be received before the date of the events. The Department of Taxes Division of Property Valuation and Review PVR is the lead. The state education property tax is based on each municipalitys grand list of properties.

The information is intended only for use by the individual or entity addressee. If you have trouble finding the district advisor assigned to your town please call the help desk at 802 828-6887. Act 60 Income Tax.

802 828-5860 VT Form RA-308 Property Valuation and Review PVR DETAILED REAPPRAISAL COMPLIANCE PLAN The TownCity of _____ hereby notifies the Director of Property Valuation and Review that a reappraisal is underway. State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To. - Property Valuation Review Division.

Property Valuation and Reviews 2015 Annual Report of the 2014 Grand List year. Honorable Shap Smith Speaker of the House Honorable John Campbell Senate President Pro Tem From. Courses presented by Property Valuation and Review are offered free of charge to municipal officials.

Jill Remick Director Property Valuation and Review Division Vermont Department of Taxes Date. Locate a District Advisor. To delineate between Act 250 vs Tax rules.

Vermont raises education funds through several tax sources including a state education property tax. Deanna Robitaille District Advisor Property Valuation and Review Vermont Department of Taxes 802 323-3411 133 State Street Montpelier VT 05603 This email may contain confidential tax information. Use the interactive district advisors map below or locate your town using the table.

The Division of Property Valuation and Review PVR staff which includes both office staff and traveling District Advisors provides support to municipalities in developing and administrating property tax policies and related programs at the local level. Division of Property Valuation and Review Department of Taxes PREPARED BY Division of Property Valuation and Review Department of Taxes 133 State Street Montpelier VT 05633 802 828-2505 taxvermontgov DATE SUBMITTED January 15 2022 Pub. The primary purpose of the Equalization Study is to assess how close the.

Jill Remick Director Property Valuation and Review Division Vermont Department of Taxes Date. Annual Report of Property Valuation and Review Division I am pleased to present the Vermont Department of Taxes Property Valuation and Review Division 2016 Annual Report of the 2015 Grand List Year. YEAR USED TO CALCULATE PROPERTY TAX ADJUSTMENTS On or before January 15 2016 the Commissioner of Taxes shall report to the General Assembly on the steps that would be required to transi on to calcula on of the property tax adjustments under 32 VSA.

This document fulfills the requirements of 32 VSA. Jill Remick Director Property Valuation and Review Division Vermont Department of Taxes. 802-828-5860 - Taxpayer Services Division.

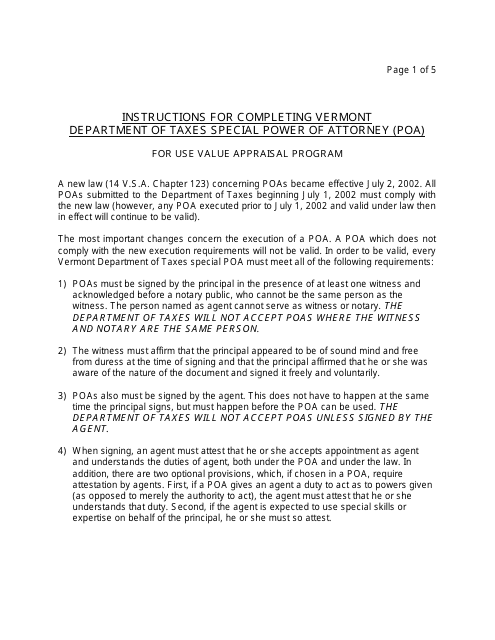

Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the propertys value of production of wood or food rather than its residential or commercial development value. The EEPVs determined as part of the 2020 equalization study are a measure of the property dollar value of a municipality. A copy will be sent to the selectboard of each town.

State of Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Agency of Administration To. The Division of Property Valuation and Review PVR conducts an annual Equalization Study of all the municipal grand lists. Appeals to the Director of Property Valuation and Review - Handbook 25571 KB File Format.

Property Valuation and Review Vermont Department of Taxes 133 State Street Montpelier VT 05633-1401 Phone. The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of dispersion COD for each school district in Vermont. Annual Report of Property Valuation and Review Division I am pleased to present the Department of Taxes Property Valuation and Review Division Annual Report of the 2016 Grand List Year.

VERMONT DEPARTMENT OF TAXES Act 46 of 2015 Sec. Annual Report of Property Valuation and Review Division I am pleased to present the Department of Taxes Property Valuation and Review Division 2019 Annual Report of the 2018 Grand List Year. Naturally enough PACE begins with 3411 which is entitled Powers of the property valuation and review division PACE asserts that 3411 does not grant PVR power to oversee or make decisions about exemptions.

The Division of Property Valuation and Review PVR of the Vermont Department of Taxes annually determines the equalized education property value EEPV and coefficient of dispersion COD for each municipality in Vermont. Ad Find Out the Market Value of Any Property and Past Sale Prices. James Knapp Interim Director Date.

January 14 2019 Subject. A copy will be provided to the selectboard of each town.

We Offer One Of The Easiest To Use Search Systems In The Real Estate Marketplace Https Www Propertyrecord Property Records Real Estate Humor Home Appraisal

Govpetershumlin Senatorleahy Sensanders Peterwelch Vt 1 In Home Repossessions Up 280 If Vt Economy Rosy Why Montpelier Vermont Restoration

Home Valuation Form Fill Online Printable Fillable Blank Pdffiller

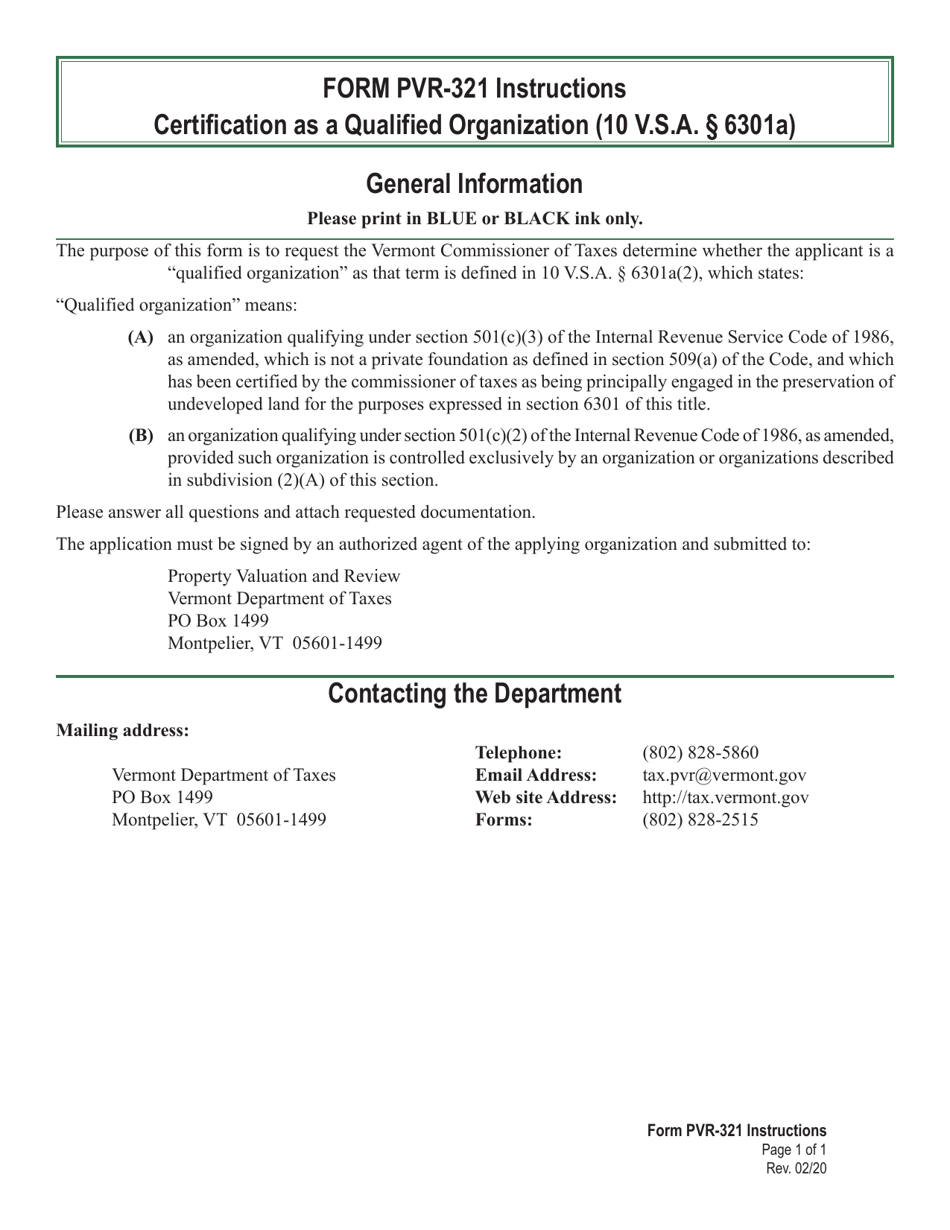

Vt Form Pvr 321 Download Fillable Pdf Or Fill Online Application For Certification As A Qualified Organization 2020 Templateroller

Vermont Special Power Of Attorney Use Value Appraisal Program Download Printable Pdf Templateroller

Municipal Officials Department Of Taxes

Fillable Online Tax Vermont Vt Form Property Valuation And Review Pvr Tax Vermont Gov Fax Email Print Pdffiller

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Facebook

Municipal Officials Department Of Taxes

Publications Department Of Taxes

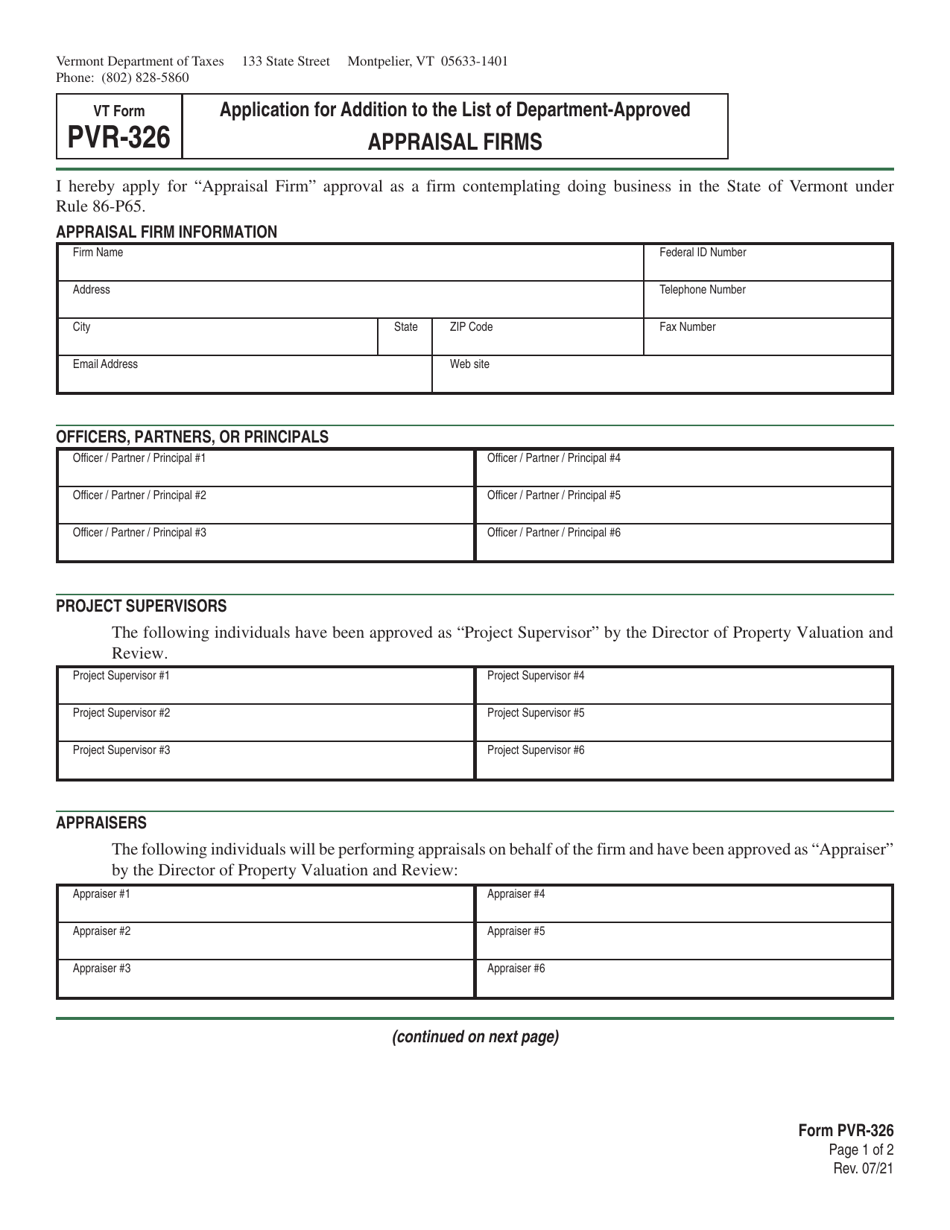

Vt Form Pvr 326 Download Printable Pdf Or Fill Online Application For Addition To The List Of Department Approved Appraisal Firms Vermont Templateroller